- Bitcoin In a Nutshell

- Posts

- 🎉 2025: The Year the Groundwork Was Set

🎉 2025: The Year the Groundwork Was Set

ALSO: A month-by-month look back at the biggest Bitcoin developments from an extraordinary year.

Happy Friday, and welcome to a special “End of 2025 Edition“ of In A Nutshell.

Instead of the usual weekly roundup, this one is 2025 Wrapped, a month-by-month look back at an extraordinary year for Bitcoin, focusing on the biggest developments beyond price.

If you enjoy the newsletter, pass it on to a friend.

🚀⏰ This special edition should be a ~5.07-minute read (807 words).

🧠 Quote Of The Week

“Learn from yesterday, live for today, hope for tomorrow.”

— Albert Einstein

❓January - What’s the Problem?

Joe Bryan launched his viral explainer video “What’s The Problem?”

With 1,000,000+ views across X and YouTube and translations into 30+ languages, it became a go-to “why” primer on the failures of our financial system—before people start learning about Bitcoin. Watch it here

⚽ February - Billionaire Backing in Bedford

The Winklevoss twins finalised a $4.5m investment to become part-owners of Real Bedford FC.

Paid entirely in Bitcoin, it helped normalise the asset as a functional way to transfer real-world value, beyond being just an investment.

🇺🇸 March - Bitcoin Reserve, & Sh*tcoin Stockpile

Trump signed an executive order creating a Strategic Bitcoin Reserve and a separate U.S. Digital Asset Stockpile.

The distinction mattered: the Bitcoin Reserve is BTC-specific (to be held as a long-term reserve asset, with agencies directed to treat it differently), while the Digital Asset Stockpile is for non-Bitcoin seized assets, with no mandate to accumulate more.

🇬🇧 April - Britain’s First Public Bitcoin Treasury

The Smarter Web Company IPO’d as the UK’s first public Bitcoin treasury company.

Being described as the “most successful IPO in UK history” it became a visible proof-point that there is a demand for Bitcoin exposure in the UK.

🏟️ May - Paris Saint-Germain Start Stacking

PSG (Paris Saint-Germain) announced it had added Bitcoin to its balance sheet.

By shifting part of its reserves into BTC, the global mainstream brand made Bitcoin treasury strategy feel more normal. It’s not just for niche tech firms, but for established institutions with huge audiences.

🔓 June - Regulated Bitcoin, Unlocked

The FCA opened a consultation to lift the ban on retail access to Bitcoin ETNs in the UK, which was eventually lifted in October.

It was a big tone shift, with UK regulators essentially acknowledging that these products exist and that retail demand isn’t going away.

🏦 July - Strategy Builds a Bitcoin Bank?

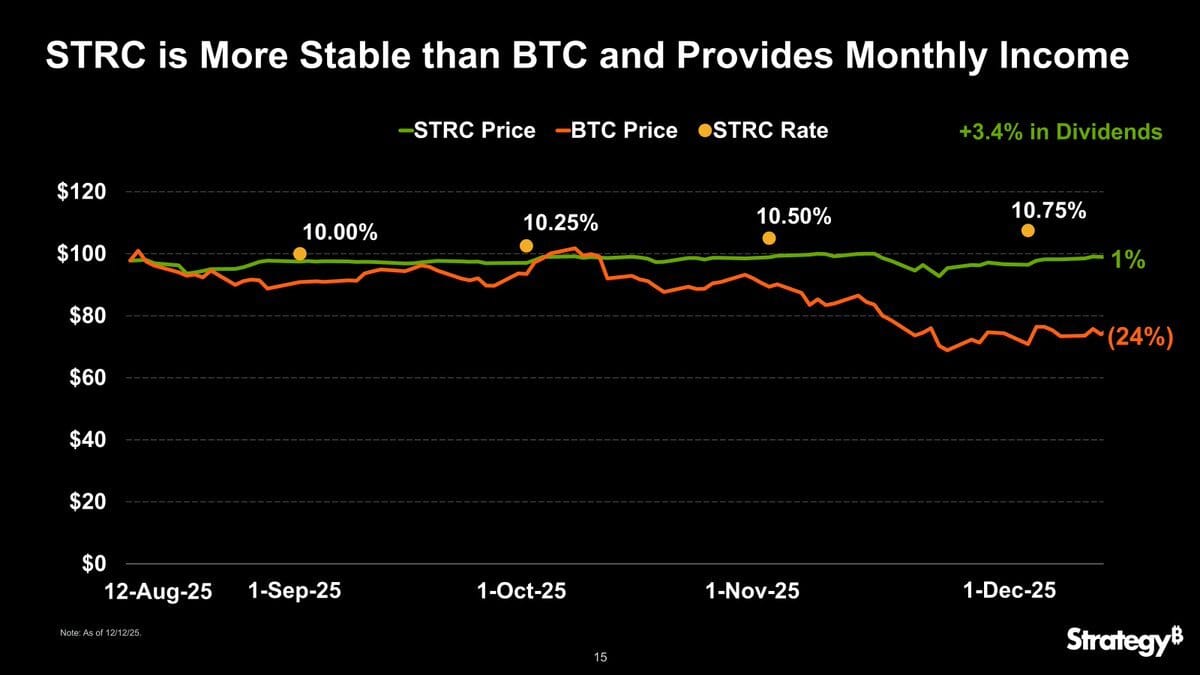

Strategy launched STRC (“Stretch”), a Bitcoin-backed preferred stock designed to trade at a constant $100 share price while paying a monthly dividend.

Saylor called it their “iPhone moment”. A money-market-style wrapper for steadier pricing and monthly income, and a key step in Strategy’s shift from a Bitcoin treasury company toward a Bitcoin-backed bank offering products that directly compete with traditional ones.

🎓 August - Harvard Warms to Bitcoin

Harvard University quietly disclosed holding an allocation via its endowment manager to BlackRocks Bitcoin ETF.

For a centuries-old institution with traditional finance rooted within its academia, this was a powerful signal of Bitcoin becoming acceptable by even in the most conservative pools of capital.

✈️ September - easyJet Land on Bitcoin

The brand behind easyJet (easyGroup) entered the world of Bitcoin with the launch of easyBitcoin.

By wrapping Bitcoin in a familiar household name and focusing on simplicity, it was another 2025 signal that Bitcoin is being normalised for everyday users.

🛒 October - Bitcoin At Every Checkout

Bitcoin payments became part of the package for U.S. merchants using Square POS systems, enabling a new low-cost way to pay across a network of over 4 million sellers.

It was a major “Bitcoin as money” milestone in 2025. Rather than a niche checkout option at a handful of retailers, Bitcoin was embedded into everyday payment rails with huge reach.

💼 November - Bitcoin: A Competitive Advantage

The Bitcoin Collective hosted “Bitcoin: A Competitive Advantage” in Derby, our first business-focused Bitcoin event in the UK.

With speakers including Liz Truss, Peter McCormack, Joe Bryan and more, it was a strong signal that Bitcoin strategy is spreading beyond public companies, as more private businesses start making serious moves to take advantage of Bitcoin.

All panels now live on YouTube

⚖️ December - Bitcoin Leaves the Legal Grey Area

The UK passed an Act confirming that Bitcoin can be recognised as personal property under the law.

This strengthens the legal footing for ownership rights, theft and fraud claims, insolvency cases, and how courts handle disputes involving Bitcoin. It moves Bitcoin further out of the legal “grey area,” making it easier for businesses and institutions to engage with confidence.

🔥 That’s everything for 2025…

🙏 Thanks for all the support this year; it really means a lot to the whole team. With that, here’s to an even bigger and better 2026 🥂✨

We’ve got big things coming in January that we can’t wait to share 👀

🧞♂️ Your wish is our command

What did you think of today's email?Your feedback helps us create better emails for you! |

Until next week✌️,

Alex & The BC Team