Happy Friday, In A Nutshell this week:

🌱 A Model Worth Copying

💀 The Same Old Obituaries

🏈 Coinbase Fumbles the Message

🇩🇰 Danske Puts Bitcoin in Your Pocket

🤔 Miners Selling Bitcoin… to Get Stronger?

…and much more

If you enjoy the newsletter, pass it on to a friend.

🚀⏰ Today’s news should be a ~4.48-minute read (723 words).

🧠 Quote Of The Week

“A lion does not concern himself with the opinion of sheep.”

— Game of Thrones

🌱 A Model Worth Copying

Non-profit Motiv is helping families in Peru earn and spend in Bitcoin through local “circular economies,” reportedly supporting around 750 households each week.

Bitcoin works without bank accounts, cuts fees and delays, and can keep value outside fragile local systems. Useful where access to finance is limited or unstable.

If this model scales, more communities could plug into open payment rails for everyday trade with lessons other regions can copy.

💀 The Same Old Obituaries

Mainstream media went hard at Bitcoin this week, with the FT arguing it is “about $70,000 too high” and The Economist calling it the “coldest crypto winter yet.”

Both pieces, locked behind paywalls, lean into bearish takes as prices fall, questioning fundamentals and confidence while overlooking the technology basics and long-term adoption signals.

Media negativity typically spikes in sell-offs, and the risk is letting these headlines set your time horizon.

Do your own research, stay humble, and stack sats if your thesis is intact.

🏈 Coinbase Fumbles the Message

Coinbase has drawn mixed reactions to its Super Bowl ad, with many labelling it a brand stunt that missed a chance to explain why Bitcoin matters.

The karaoke-style spot felt like a bait and switch: taking something universally loved and slapping “crypto” on it. The reveal fell flat with viewers. Watch here

For many who bought during past cycles (2017 onwards) and lost money, “crypto” already feels like a scam. Messaging like this risks widening that gap and turning people off learning about the sound-money principles of Bitcoin.

🇩🇰 Danske Puts Bitcoin in Your Pocket

Danske Bank now lets customers get Bitcoin exposure in its online and mobile apps via exchange-traded products from BlackRock and WisdomTree.

The bank says the ETPs fall under MiFID II for transparency and investor protection, and customers must pass an appropriateness check before trading.

Bringing Bitcoin access inside a major Nordic lender’s banking apps could pull more savers into regulated products across Europe, especially since no separate crypto wallet is needed.

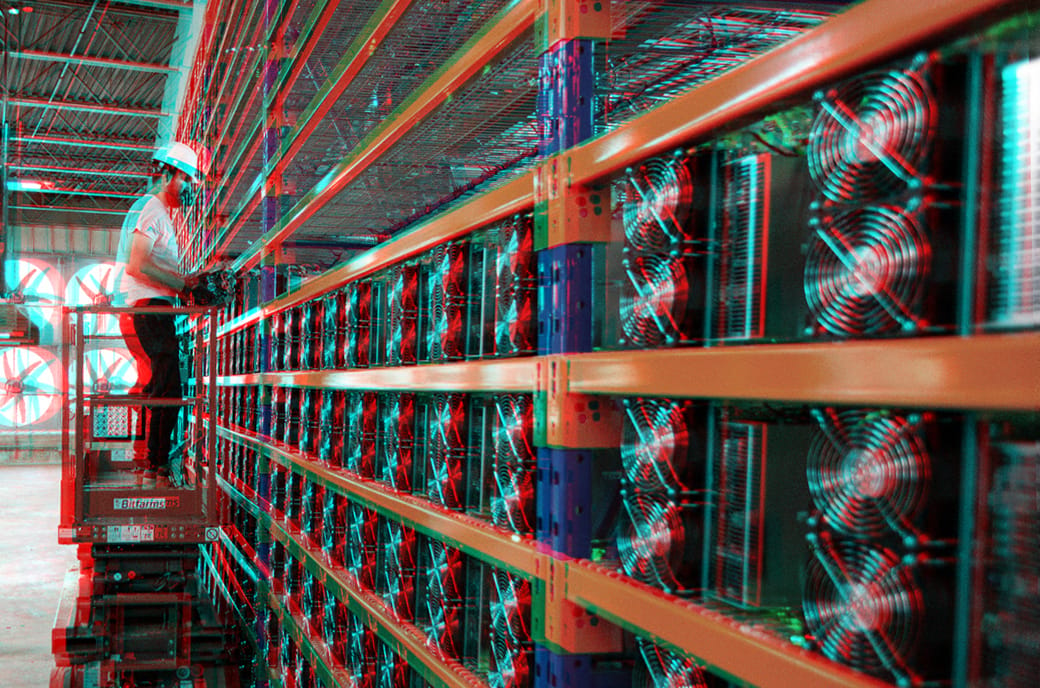

🤔 Miners Selling Bitcoin… to Get Stronger?

Bitcoin miner Cango sold 4,451 BTC for about $305m, using the proceeds to repay a Bitcoin-backed loan as part of a balance-sheet optimisation plan.

The move comes as Cango pivots beyond pure mining, appointing an AI-focused CTO and planning GPU infrastructure, while miners face tighter margins post-halving.

Expect more miners to sell BTC to deleverage or diversify, adding short-term selling pressure that may weigh on Bitcoin’s price.

🌍 Step Back From the Tech, Focus on Impact

We’ve just dropped a 6-minute video explaining why Bitcoin matters, and what an open monetary network could enable for the world.

It’s simple, practical, and easy to share, built for founders and leaders who want the significance without a technical deep dive.

If you’re speaking with business owners or executives who say, “I get the hype, but why does this matter?” this is the video to send.

🔥 What else have you missed?

1. Bitcoin mining difficulty drops 11% in largest negative adjustment since China's 2021 ban

2. BIP 360 has been merged into the official Bitcoin BIPs repository, aiming to strengthen Bitcoin against quantum

3. Lightning Labs releases AI agent tools for native Bitcoin Lightning payments

4. Cash App lower fees across the board for people using Bitcoin

5. Bernstein targets $150K in 2026, calling this selloff the ‘Weakest Bear Case in History’

6. Jack Mallers says levered software capital is being washed out, letting Bitcoin finally trade like hard money

7. Standard Chartered sees Bitcoin falling to $50,000

8. Fear & Greed Index falls to the lowest ever

9. Dutch House backs 36% unrealised gains tax

10. BlackRock say 1% Bitcoin Allocation in Asia Could Drive $2 Trillion in Inflows

🧞♂️ Your wish is our command

What did you think of today's email?

Until next week✌️,

Alex & The BC Team