- Bitcoin In a Nutshell

- Posts

- 🇬🇧 The UK Catching Up?

🇬🇧 The UK Catching Up?

ALSO: A New Corporate Whale Enters the Chat; Bloomberg states "Bitcoin Acts Like A Safe Haven"; Bitcoin Is Now The 5th Largest Asset; Panama City to Accept Bitcoin for Taxes

Happy Friday, In A Nutshell this week:

🇬🇧 The UK Catching Up?

🚀 Bitcoin Is Now The 5th Largest Asset

🏦 A New Corporate Whale Enters the Chat

🇵🇦 Panama City to Accept Bitcoin for Taxes

📺 Bitcoin, Not Crypto

…and much more

If you enjoy the newsletter, pass it on to a friend, and you can earn free sats (see bottom of the email).

🚀⏰ Today’s news should be a ~3.51-minute read (572 words).

🧠 Quote Of The Week

“Every act of creation is first an act of destruction.”

– Pablo Picasso

🇬🇧 The UK Catching Up?

The Smarter Web Company is now officially a public UK company holding Bitcoin.

In a country where the FCA still bans Bitcoin ETPs for retail, this is a big step. It’s rare to see a UK-listed business adopt a Bitcoin treasury strategy, especially from day one of listing.

Our latest podcast just dropped with founder and CEO Andrew Webley. Discussing why he made the move, how he’s thinking long-term, and what this means for companies building in the UK.

The episode is available here: YouTube, Apple Podcast, Spotify

🚀 Bitcoin Is Now The 5th Largest Asset

Bitcoin overtook Google this week, climbing to 5th place globally by market cap, before being edged back down.

At its peak, it hit $1.87 trillion, putting it ahead of Google and just behind NVIDIA. It’s steadily climbing the ladder

Not bad for 15-year-old open-source software with no CEO, HQ, or marketing team.

It’s getting harder to ignore. The question isn’t “Is Bitcoin going away?”

The question is: Are you paying attention?

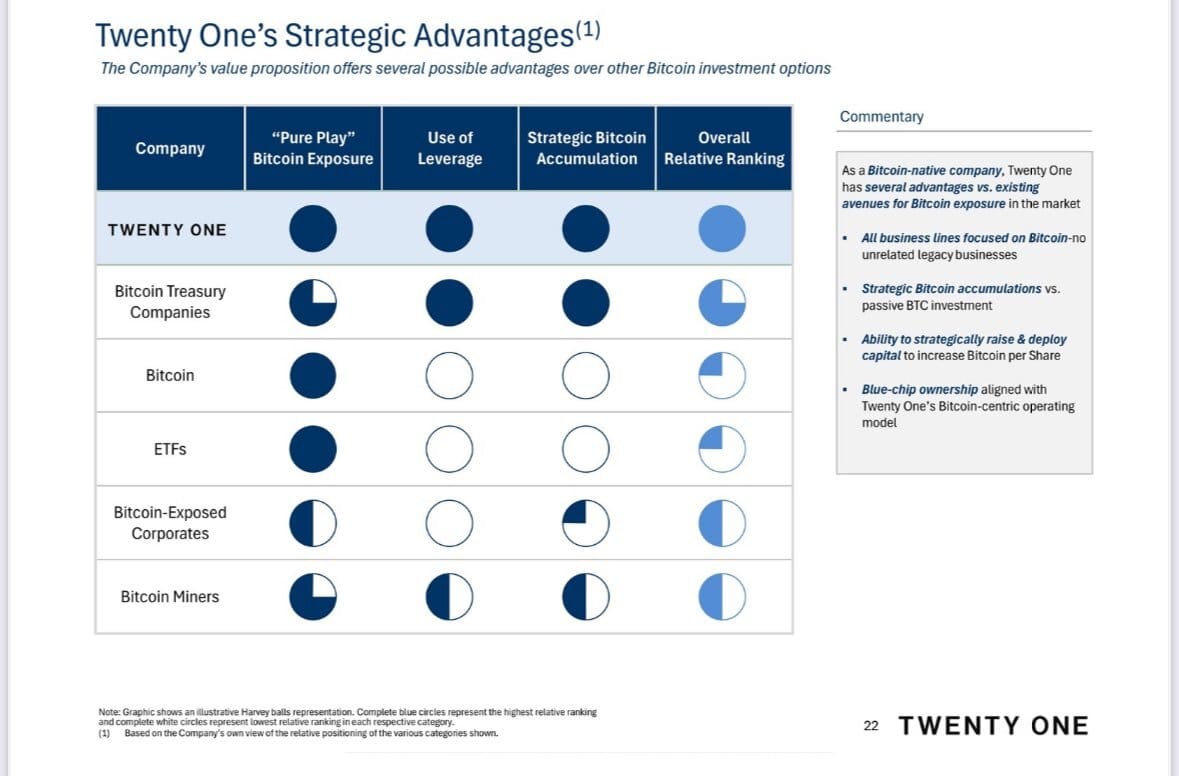

🏦 A New Corporate Whale Enters the Chat

Wall Street brokerage Cantor Fitzgerald is launching a new Bitcoin venture, Twenty One Capital, in partnership with Tether and SoftBank.

The venture is set to go public via a SPAC merger with Cantor Equity Partners, valuing the combined entity at $3.6 billion. With over 42,000 bitcoins at launch, Twenty One Capital will become the world's third-largest corporate holder of Bitcoin.

Led by Jack Mallers, Twenty One Capital aims to emulate the success of firms like Strategy, leveraging Bitcoin as a core treasury asset.

🇵🇦 Panama City to Accept Bitcoin for Taxes

Panama City has partnered with Towerbank to allow residents to pay municipal taxes, fees, and permits using Bitcoin, Ethereum, USDC, and USDT.

Mayor Mayer Mizrachi highlighted this move as a significant step toward integrating digital currencies into the city's economy, positioning Panama City as a leader in Bitcoin and crypto adoption within Latin America.

📺 Bitcoin, Not Crypto

If you’re trying to explain the difference between Bitcoin and “crypto”, this is the series to send.

Parker Lewis and Dhruv Bansal just released a 3-part video presentation breaking down:

Why Bitcoin matters

Why it’s not just “blockchain”

Why everything will eventually be built on Bitcoin

🔥 What else have you missed?

1. Bloomberg says "Bitcoin Acts Like A Safe Haven"

2. Bitcoin, Not Crypto: Why Bitcoin-Only VC Will Win.

3. SEC is teaming up with El Salvador’s National Digital Assets Commission (CNAD).

4. ARK Invest updates their 2030 Bitcoin price prediction to $2.4 million.

5. With a 620 BTC treasury and 709.8% YTD BTC yield, The Blockchain Group is now the top-performing stock on the Paris exchange.

6. Bitcoin campaigners call for Swiss central bank to hold bitcoin (Reuters).

7. The Federal Reserve has withdrawn its guidance for banks on Bitcoin and crypto.

🧞♂️ Your wish is our command

What did you think of today's email?Your feedback helps us create better emails for you! |

Until next week✌️,

Jordan & The BC Team